Accounts Payable: Definition, Example, Journal Entry

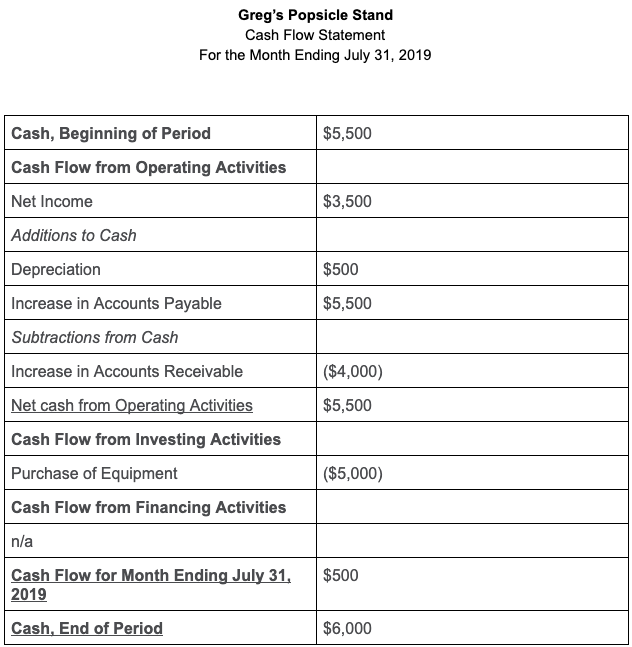

To calculate the accounts payable turnover ratio, you divide net credit purchases by average accounts payable. Excluding payroll, accounts payable includes all outstanding expenses your business owes for goods purchased and services received. Because accounts payable expenses are not immediately paid, they are considered balance sheet accounts liabilities in your accounting records. In order to effectively manage cash flow and maintain good relationships with vendors, it’s important to measure AP regularly. There are several KPIs that AP teams use to measure their performance. The accounts payable turnover ratio is one of the most common metrics.

Accounts Payable vs Accounts Receivable

Automating the accounts payable process reduces labor costs by digitizing manual processes like invoice processing and data capture. Some people mistakenly think that accounts payable are business expenses. As outlined in the previous section, accounts payable are liabilities reported on the balance sheet. On the other hand, business expenses are reported as expenses on the income statement. Accounts payable are usually due within 30 days, and are recorded as a short-term liability on your company’s balance sheet.

Foreign Currency Accounting for Small Businesses

Because accounting books must be balanced on both sides of the ledger, the accounting entry is also recorded as a corresponding debit to another account. If you have many suppliers and lots of different accounts payable, it can get difficult to remember exactly who you owe what. Some businesses will create an accounts payable aging schedule to help keep track. Accounts payable are a liability account, representing money you owe your suppliers.

How can Taxfyle help?

- Accrual accounting requires firms to post revenue when earned and expenses when incurred to generate revenue.

- Here is another example to help illustrate what this might look like.

- Accounts Payable (AP) is generated when a company purchases goods or services from its suppliers on credit.

- The company must pay this debt within a given time to avoid defaulting.

Trade payables fall under accounts payable, and some companies simply combine the two into one accounts payable process. As an important cash flow indicator, accounts payable is a sign of the health of a business. To ensure consistent and accurate financial information, a dependable accounts payable process is vital. Properly managing accounts payable is also important in maintaining good business relationships with vendors and suppliers. Since accounts payable are debts a company owes to creditors, they are considered liabilities. That means that they will be taken from your account whenever you pay a debt.

How Accounts Payable and Accounts Receivable Compare

The travel management by the AP department might include making advance airline, car rental, and hotel reservations. While the business size ultimately determines the role accounts payable plays, AP fulfills at least three essential functions besides paying bills. Say Robert Johnson Pvt Ltd pays cash within 10 days to take advantage of a 2% discount. In that case, the journal entry in the books of James and Co would be as follows. Furthermore, based on Walmart’s payment schedule, its suppliers can determine the credibility of the company.

They’re recognized under the accrual method of accounting at the time they’re incurred, not necessarily when they’re paid. To expand your offerings and better serve your clients, today’s accountants need a complete solution to streamline operations and automate the accounts payable process. AP Processes differ slightly for every organization https://www.simple-accounting.org/ based on the volume of transactions within a company. But they all seek to streamline their processes to improve cash flow and working capital management. Payroll service is a debit account, while AP is a credit account in the trial balance. AP’s are liabilities due within a given time frame and are personal accounts by nature.

On the other hand, accounts payable are a liability that has to be paid off in a short period of time. To gauge the profitability of your business, determine the total of your assets and accounts receivable. In contrast, a negative balance indicates that you need to rethink your current business model and limit expenses to avoid being in the red. Once an invoice is received, items classified within the accounts payable are recorded as liabilities in a ledger. Accounting and finance teams are responsible for receiving invoices and issuing payments before the due date to avoid penalties.

If discrepancies arise with the quantity or price, the AP department sends the invoice back to the purchasing department to rectify it. With the information available with the supplier in the delivery confirmation report, the supplier can either reject or accept the discrepancies and provide credit for the same. Discover key regulations, tax insights, and tips for success in the Aloha State’s unique market.

Lastly, if the receivables are paid back after the discount period, we record it as a regular collection of receivables. As of April 2023, Glassdoor has over 38,000 job listings related to accounts payable in industries such as education, manufacturing, construction, and health care. In an ever-changing tax and accounting landscape, is your firm truly future proof? To understand the ins and outs of accounts payable, let’s take a look at some frequently asked questions. It is also the independent department in an organization or a company that works actively to handle debt operations.

The person, or people, responsible for accounts payable varies depending on the size of a company. They finalize the mode of payment and the date, considering all the factors and where the company has taken maximum benefit for the credit period. Materials, inventory, or supplies purchased on credit impact the trading account and thus translate how the organization arrives at its ‘gross profit’ calculation. A considerable part of operations involves moving goods from one place to another, and often these services are taken on a contract basis.

The introduction of AP automation has revolutionized the way companies handle their payable accounts. This technology, which often incorporates elements of artificial intelligence and machine learning, automates various tasks like invoice capture, data entry, and payment processing. The accounting process is highly subject to human error, especially during manual data entry. Paper invoices also cause problems because documents can get lost or duplicated. That’s why companies are turning to accounts payable automation to streamline AP business processes.

Quickbooks online accounting software categorizes your transactions and breaks them down into various categories. Accounts payable is the total amount of short-term obligations or debt that a company has to pay to its creditors for goods or services bought on credit. The vendor’s https://www.quick-bookkeeping.net/how-small-businesses-can-prepare-for-tax-season/ or supplier’s invoices have been received and recorded. Payables should represent the exact amount of the total owed from all the invoices received. Some businesses may categorize accounts payable into trade payables and expense payables and track those accounts separately.

Accounts payable professionals manage or execute functions related to paying outstanding invoices on behalf of a company. Accounts Payable (AP) is generated when a company purchases goods or services from its suppliers on credit. Accounts payable is expected to be paid off within a year’s time or within one operating cycle (whichever is shorter). AP is considered one of the most current forms of the current liabilities on the balance sheet.