Undo a clients reconciliation in QuickBooks Online Accountant

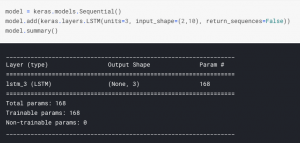

These tailored functionalities contribute to the efficiency and accuracy of professional accounting workflows within the QuickBooks Online Accountant platform. Are you facing reconciliation issues in QuickBooks Online? Don’t worry, we’ve got you covered with a step-by-step guide to help you fix how to undo a reconciliation in quickbooks online. Review the transactions that were reconciled incorrectly.

Edit completed reconciliations

Remember to review all transactions carefully after undoing a reconciliation to ensure accuracy. If any discrepancies are found, make necessary adjustments before re-reconciling. This process may seem daunting at https://www.business-accounting.net/work-with-sox-reports/ first but with practice, it will become second nature. Undoing reconciliations in QuickBooks Online Accountant is just another tool in your arsenal for maintaining precise financial records for your clients.

Step 1: Navigate to Chart of Accounts

You’ll get a warning that your account isn’t ready to reconcile because your beginning balance is off by the amount of the transaction or transactions you un-reconciled. Click on “We can help you fix it” to review the transactions you un-reconciled in Step 6. Make sure these match the transactions you meant to un-reconcile. You’ll want to look at your statement, starting with the first transaction listed and find that same transaction in the Reconciliation window in QuickBooks. If your firm uses QuickBooks Online Accountant, you have a special reconciliation tool.

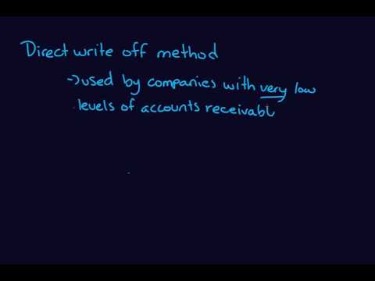

Categorization errors

This is especially important the first time that you carry out a reconciliation. The opening balance should match your bank account balance period in question. QuickBooks Online will automatically check transactions entered using the bank feed feature on the reconciliation screen. If your filters are set up incorrectly, you could reconcile a transaction that hasn’t cleared the bank yet, causing problems down the line. You will, however, want to regularly reconcile any short-term or long-term liability (loan) accounts to make sure the principal due and the interest paid are correctly accounted for in QuickBooks. The process for reconciling these accounts is the same as the process for reconciling a bank or credit card account, and it typically takes only moments to do.

QuickBooks will load the statements and facilitate a side-by-side comparison. If QuickBooks is not connected to online accounts, the statements will not be loaded. Having up-to-date and accurate accounts is important for any business. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you.

Undo an entire reconciliation

Let me know if you have additional questions or clarifications about recording refunds from a vendor. We appreciate you for posting your concern here in the Community. Let me help you regarding your deleted reconciled entries inside QuickBooks Online (QBO). I’m eager to take this opportunity to help you record this transaction in QuickBooks Online. You’ll also want to add integrations with any other business software service you already use.

You can also make small edits if needed right within this window. For example, if the payee is wrong, you can click on the transaction to expand the view and then select Edit. I’m sharing insights about undoing reconciliation without using QuickBooks Online accountant, Breeeze.

Reach out to me directly if you have additional questions about working in QBO. The “History by account” button is visible on the upper righthand corner here. QuickBooks Accounting supports integrations with other payroll services, but it offers its own software as well.

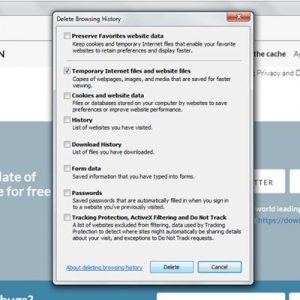

Next, review your bank and credit card statements carefully to match them with the transactions in QuickBooks. If you notice any duplicates or missing transactions during this process, reconcile them promptly to avoid future complications. Utilize https://www.intuit-payroll.org/ the built-in reconciliation tools within QuickBooks Desktop to help identify and rectify any discrepancies that may arise during the process. Don’t hesitate to reach out for support from the QuickBooks community or customer service if needed.

Ensure that the account chosen matches the one for which the erroneous reconciliation was originally completed. For instance, if the reconciliation was mistakenly performed for the Bank of America checking account, be sure to select this specific account for deletion. This step is crucial to ensure that the unreconciling process accurately targets the intended account for deletion in QuickBooks Online.

Or sometimes the beginning balance or ending balance on the account for the period you’re reviewing was entered wrong. We recommend reviewing your opening, beginning, and ending balances first to be sure you’ve ruled out any possible errors. If you use a different version, you can undo a reconciled statement by manually unreconciling each transaction.

To start the process, you would first need to open QuickBooks and navigate to the Banking menu. From there, you should select Reconcile and then locate the account for which you want to undo the reconciliation. Once the account is selected, you can click the “Undo Last Reconciliation” option. QuickBooks will prompt you to enter the date of the reconciliation you wish to undo. After selecting the account, locate and click on the designated ‘Delete’ button within the QuickBooks Online interface to initiate the reconciliation deletion process. Once within the Reconcile Page, identify and choose the specific bank account for which the reconciliation undo process needs to be initiated in QuickBooks Online.

- If you use QuickBooks Online as your accounting software, there are two different processes you can follow to undo reconciliation.

- Let’s get this sorted out so you’ll be able to unreconcile your statement in QuickBooks Online (QBO).

- Once on the Reconcile Page, identify and select the specific account for which you intend to undo the reconciliation in QuickBooks Online.

- Are you facing reconciliation issues in QuickBooks Desktop?

It’s important to note that the steps for undoing reconciliation in QuickBooks Online differ from the desktop version, as the interface and navigation options are tailored to the specific platform. The Account Selection tool simplifies the process by enabling users to pinpoint the exact account they need to reconcile, saving time and ensuring accuracy in the deletion process. This feature streamlines the adjustment process, ensuring accuracy and transparency in financial records within QuickBooks Online. Upon clicking the ‘Undo’ button, QuickBooks Online will prompt a confirmation dialogue to ensure the intentional initiation of the reconciliation undo process. For more details, you can use this link that will help you through reconciling an account and how to pull up the reconciliation reports. To undo a reconciliation the user has to change the R in the status column of the transaction in the bank register to a C or leave the it blank.

It streamlines the process of correcting errors and ensuring accurate financial records in a user-friendly way. Accuracy in reconciliation modifications is crucial for maintaining reliable financial data, ensuring compliance with accounting standards, and facilitating informed decision-making. cost of goods sold Just like balancing your checkbook, you need to review your accounts in QuickBooks to make sure they match your bank and credit card statements. You’ve just learned how to undo a bank reconciliation in QuickBooks Online by making corrections to the individual transactions that were reconciled.

This user interaction is crucial to prevent accidental data modifications and ensures that you are intentionally reversing the reconciliation process. Once confirmed, QuickBooks Online will execute the undo action and provide a notification to acknowledge the successful completion of the reconciliation adjustment. You can easily locate the account by scrolling through the list of linked accounts and choosing the one that requires adjustment.