Forex Line Chart

Contents:

Japanese https://forexarena.net/s charts consist of a series of thin vertical lines. Each candlestick appears after the previous one has closed. Several consecutive candlesticks, one above the other, form a rising trend, and the same with a downtrend. As the candlesticks are of different colours, it is much easier to identify trends in the chart, because they look like a series of lines of the same colour. Let’s see the main features of the candlestick chart. The candlestick consists of a black/red or white/green body and top or bottom shadow.

27 time frames including tick charts and flexible line tools. It also presents a vast range of technical indicators as Linear Regression, CCI, ADX and many more. A small horizontal line sticking out from the left side of the bar is the opening price. The small horizontal line sticking out from the right side of the bar is the closing price.

In a stacked line chart, the data values are added together. Line charts are simplistic and may not fully capture patterns or trends. Taken on its own, a doji is a neutral pattern of little significance.

In Forex, a line chart is the most basic and simple price representation. Basically, it marks various price points of a certain asset on the diagram and then connects the neighboring points to each other with a continuous line. To avoid confusion, when talking about the ticks on a line chart, most analysts will call them price points or data points rather than ticks. Candlesticks are easy to interpret and are a good place for beginners to start figuring out chart analysis. In the following example, the ‘filled color’ is black. For our ‘filled’ blocks, the top of the block is the opening price, and the bottom of the block is the closing price.

TradingView: Changing forex technical analysis – London Business … – London Loves Business

TradingView: Changing forex technical analysis – London Business ….

Posted: Mon, 27 Feb 2023 14:17:45 GMT [source]

Sometimes the price may even hover near the neckline before making the real move. In just one click, you can export and save images (.png) of your graphs (with all your indicators, lines, drawings,…) for later analysis and review. Search for the “PNG” icon.How to export images of your plot. Once you have customized with all the options you need to analyze and trade the asset, you can save it. So when you come back to the board, it’s ready for you to work on! How to save your configurationandHow to load your configuration.

Forex Bar charts

If the https://forexaggregator.com/frame is M30, each candlestick displays the range of the price changes every 30 minutes. You will learn more about the candlestick chart further in this article. First, you need to open a demo account after you register on the LiteFinance website.

Forex signals are bits of information that you can get about the market from a signal service, such as an app, email alert service, or texting service. Some signals may simply provide information , while others can advise you to take certain actions, like buying or selling. Get familiar with the format used by your chosen signal service so you know what the signals mean and how to use them. For example, if the overall chart appears to indicate an upward trend, you might want to go back further to see when that trend began.

Intro to Basic Chart Types

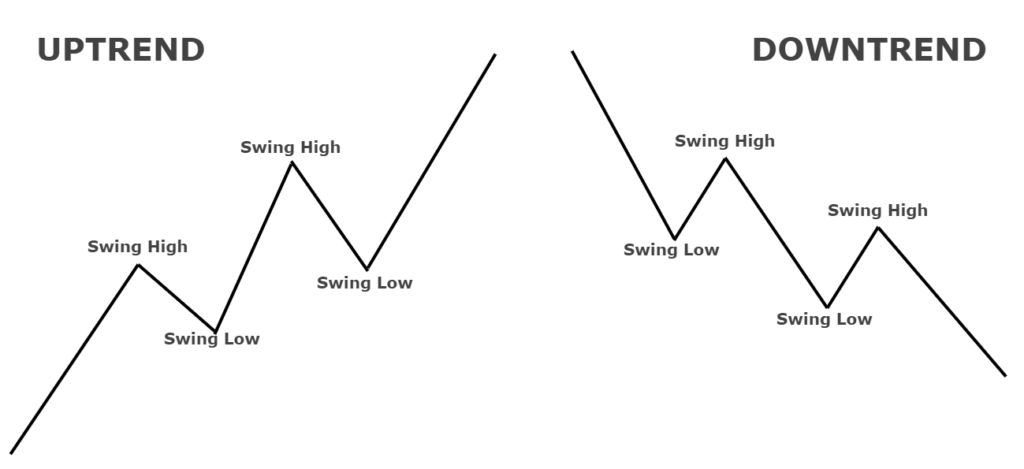

Similarly, it’s rare to find a trend line that lines up perfectly with the open or close of each candle. This is a perfect example of the type of buying opportunity a trader would look for using trend line support. There are three very important keys to drawing effective trend lines. Similar to the GBPUSD uptrend in the first chart, this AUDNZD downtrend touched off of our trend line several times over an extended period of time.

As with all such advisory services, past results are never a guarantee of future results. The live bars chart shows not only the closing price but also the high and the low that the price reached on any given timeframe. Utilize our free live real-time chart for currency pairs, cryptocurrencies, stocks, indices, commodities, and futures. Click on the top left of the below chart to search for any financial symbol or ticker, or simply type the asset’s name. The body of a candle tells the open and close prices, while the wicks represent the high and low prices. Besides those four pieces of information, the candlestick uses colors to tell if the price closed above or below its opening level.

The Japanese candlestick theory establishes a series of patterns which are statistically previous to potential change or interruption of trends, a turning point in a current trend, etc. This type of chart is used in a special work strategy called Arbitrage. In modern trading, there are two basic approaches to the forecasts for price in the future. The first is the analysis of everything that surrounds a financial asset or fundamental analysis. The second one is the analysis of the price itself, or technical analysis. Cash incentives may improve home choosing. We will provide options based on your budget and home preferences. Our experts will explain the home’s location, features, and condition. Visit https://www.webuyhouses-7.com/georgia/we-buy-homes-waycross-ga/.

What Is an Example of a Line Chart?

Intraday charts are usually used by traders who seek to gain profits over a short period. Intraday trades are entered and exited within the same trading session or day. Day traders usually use 1-hour to 4-hour charts to guide their trading ideas. Day trading positions are usually held for several minutes to a handful of hours. Scalpers, though, can be even more aggressive and often use 1-minute to 15-minute trading charts. Scalpers seek tiny profits which can be captured within several seconds or a few minutes.

- When you’re looking at a Forex chart, you’ll see rectangular symbols that look like candles – these indicate opening price and closing price.

- The horizontal or x-axis denotes time and the vertical or y-axis denotes prices.

- But today, we have the luxury of changing the colors to whatever we want.

There are many trading strategies, applying Japanese Candlestick charts. There has even been developed a particular type of technical analysis that is called candlestick analysis. The analysis suggests looking for repeating combinations of similar candlesticks.

Candlesticks are good at identifying market turning points – trend reversals from an uptrend to a downtrend or a downtrend to an uptrend. Here at BabyPips.com, we don’t like to use the traditional black and white candlesticks. Candlestick bars still indicate the high-to-low range with a vertical line. Bar charts are also called “OHLC” charts because they indicate the Open, the High, the Low, and the Close for that particular currency pair. When you see the word ‘bar’ going forward, be sure to understand what time frame it is referencing. The horizontal hash on the left side of the bar is the opening price, and the horizontal hash on the right side is the closing price.

From there, look to see if you can connect a trend line with the subsequent lows or highs . This retest gave traders the opportunity to sell the pair, which would have resulted in a substantial gain over the next several days as the market sold off. So if a trend line doesn’t fit well, it’s probably best to move on to another pattern.

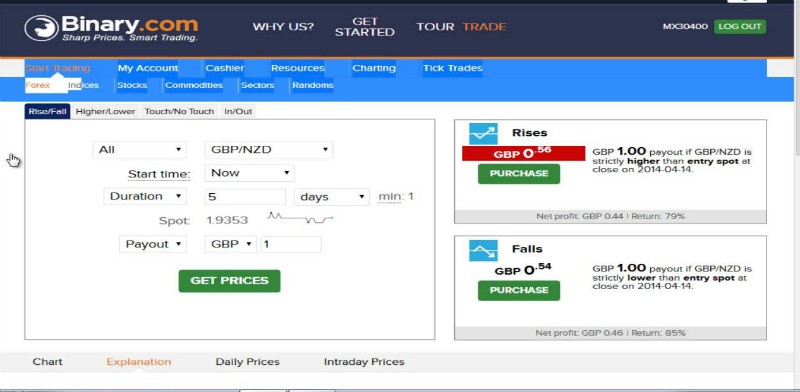

This type of forex chart provides very little information on the chart and is therefore not very popular among forex traders. Volatility indicators, such as ATR and Bollinger Bands, help traders measure the rate of price fluctuations in an underlying asset. This can help traders to filter out which markets to trade with an appropriate strategy. For instance, a risk-averse trader will look to trade low volatility markets or to utilise low stake amounts in high volatility markets. As an example, Bollinger Bands converge when there is low volatility, and they diverge when there is high volatility.

In the 1-hour chart of the US dollar against the Japanese yen,the pattern of”small Yinxian-medium Yinxian-big Yinxian”appears alternately in this downtrend,forming a strong unilateral downtrend. But today, we have the luxury of changing the colors to whatever we want. And the most common colors are green for bullish candles and red for bearish ones. A Forex chart is a kind of a window that gives us a glimpse of the forex market.

Long green candlesticks may indicate that there is a lot of buying pressure, while long red candlesticks may indicate a lot of selling pressure. With line charts, drawing a trendline is an easy task. Drawing trend lines is subjective, is not a precise science.

- Oscillators are much more accurate with this chart type.

- Should the lines be placed at the top of the body this will tell you the high and close price, while the line at the bottom of the graph indicates the low and the low’s close price.

- To get this information, you should switch to a shorter timeframe of the chart.

- How can short-term foreign exchange operations achieve a high winning rate?

These sthttps://trading-market.org/gies seek to gain the bulk of profits over significant short to medium price changes in the markets. The time horizon for swing trades ranges from a few days to a few months. Swing traders can also use week charts as a long-term guide to their trading bias.

It is the variable thickness of lines in charts of this type that is the signal for traders to enter a trade. This chart type is basically a technical indicator, as it combines major principles of EMA. Kagi chart has a basic parameter of the trend reversal level that is, by default, 4% of the previous price movement. Point and Figure charts originated in the middle of the 19th century by the first technical traders. It was not basically a chart, rather it was forecasting method, using point and figures.

The horizontal axis shows you the time and the vertical axis shows you the price. The price always goes to the right, and you look left when you want to see past price data. When the price is rising it’s called a bullish price action and when the price is falling it’s called a bearish price action. The line chart is best for higher time frame charts, since it gives the trader only a sense of the price direction and not the finer details of open and close levels.